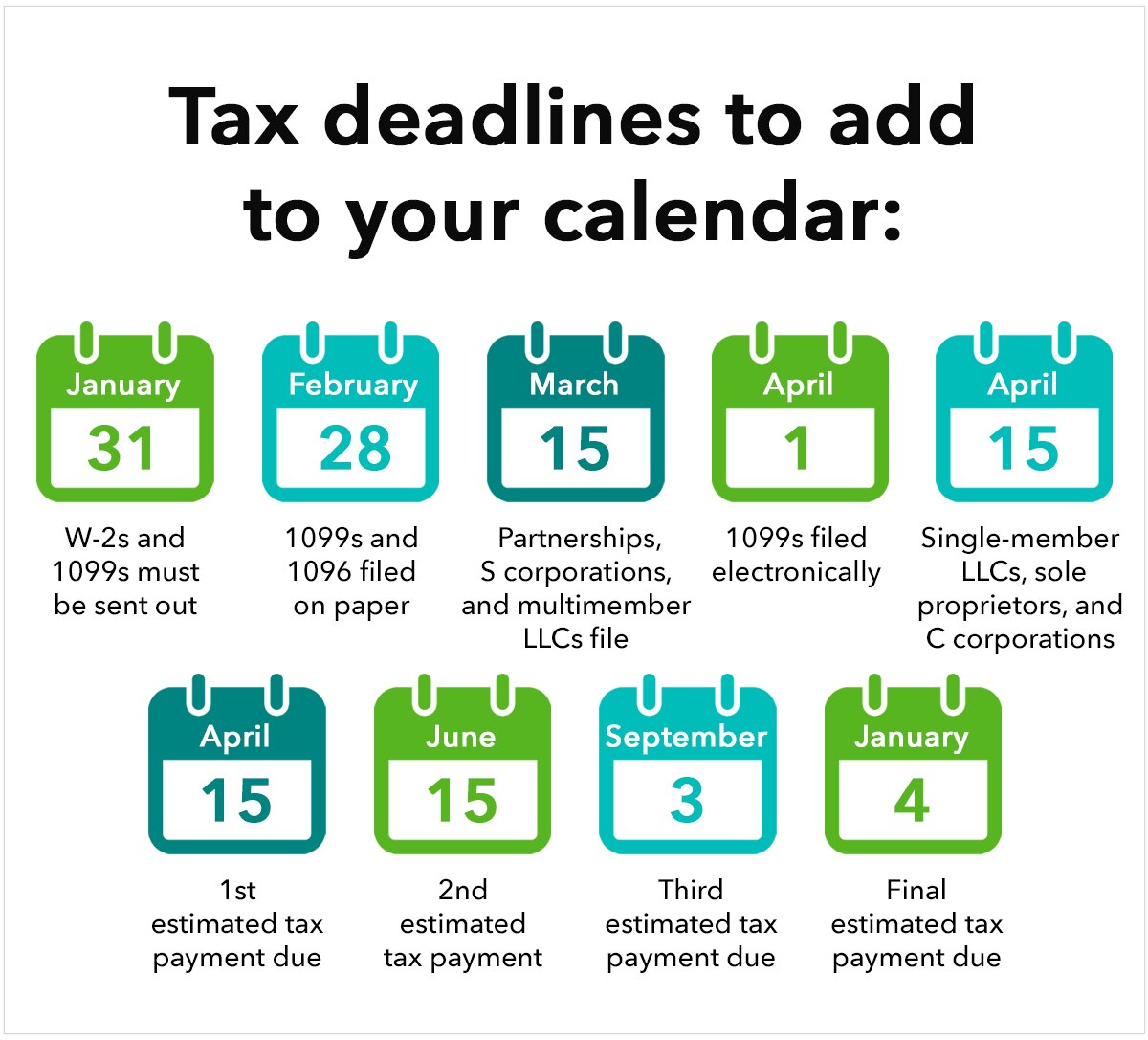

Small Business Tax Calendar 2026 Modern Present Updated. Avoid penalties with timely filings. As per the latest amendments, companies requirements for the compliances have been changed in comparison to the.

A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. As per the latest amendments, companies requirements for the compliances have been changed in comparison to the. Avoid penalties with timely filings.

Source: www.dreamstime.com

Source: www.dreamstime.com

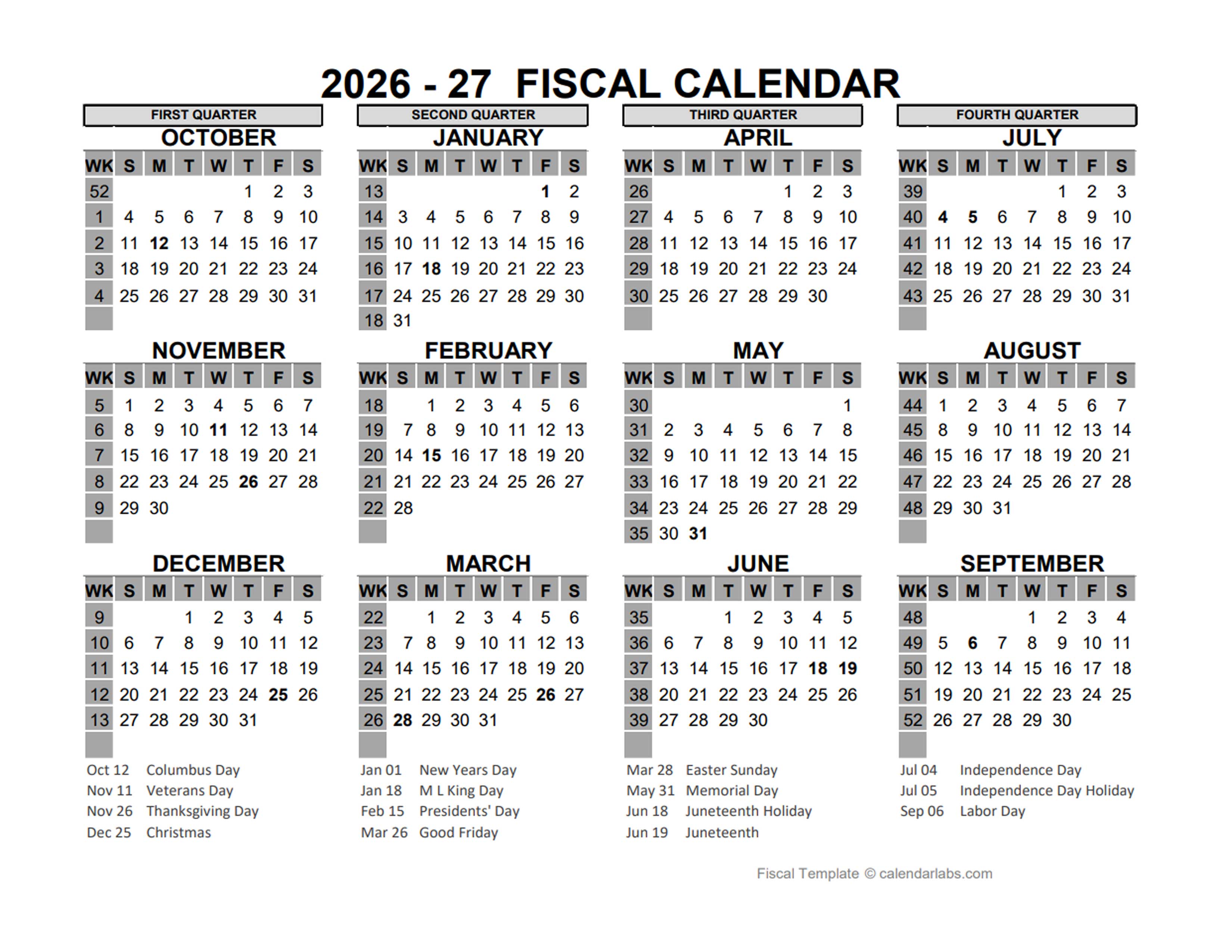

Calendar Planner for 2026. Calendar Template for 2026. Corporate and A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. This comprehensive guide outlines all the important dates—from advance tax payments to the filing of various statutory forms—that you need to monitor.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

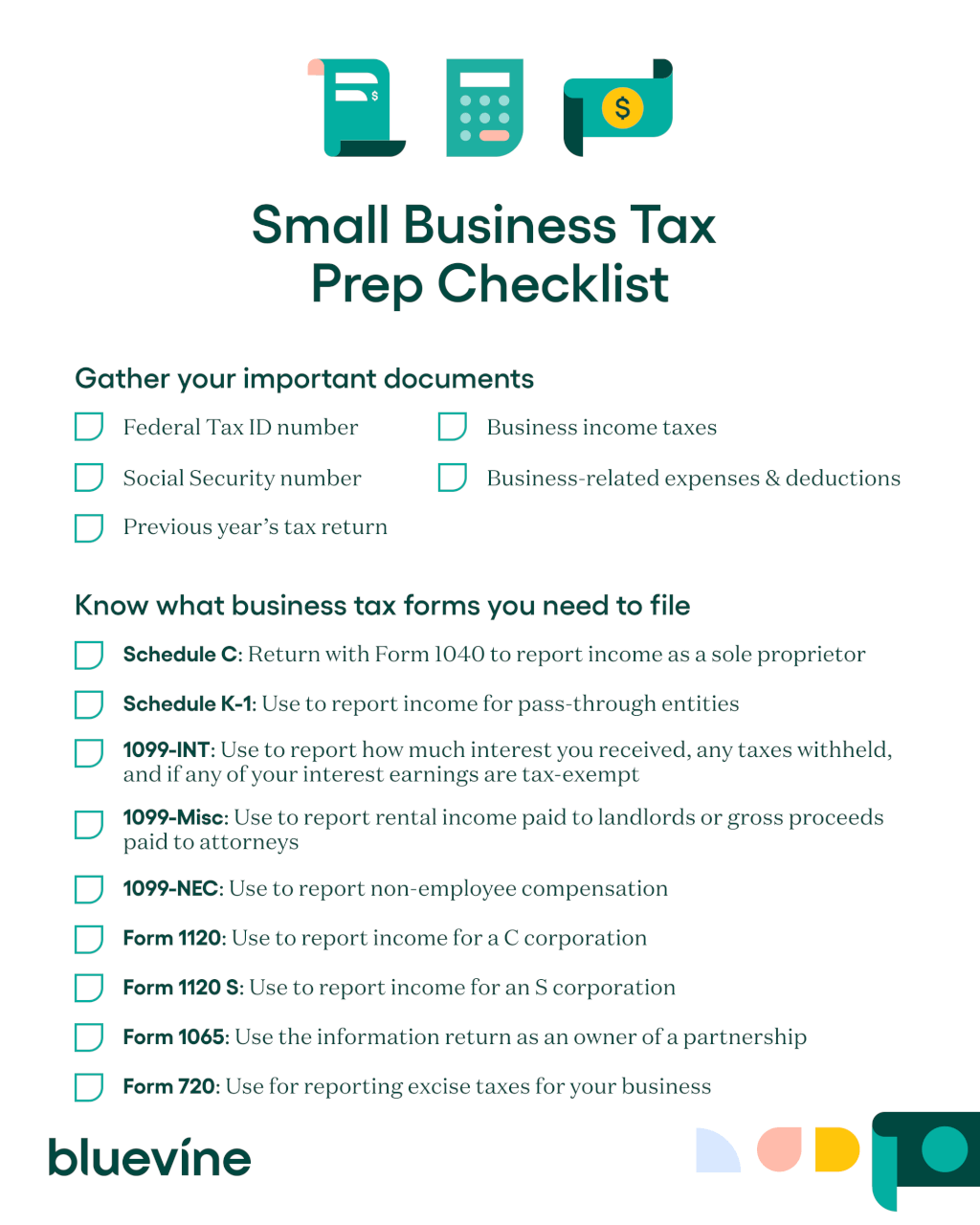

Small business tax prep checklist What business owners should know This comprehensive guide outlines all the important dates—from advance tax payments to the filing of various statutory forms—that you need to monitor. As per the latest amendments, companies requirements for the compliances have been changed in comparison to the.

Source: www.bluevine.com

Source: www.bluevine.com

A Guide to Small Business Taxes Bluevine Bluevine Avoid penalties with timely filings. The due date for belated and revised.

Source: glentlopez.pages.dev

Source: glentlopez.pages.dev

Navigating The Fiscal Year 2026 Pay Period Calendar A Comprehensive The due date for belated and revised. In april 2025, major compliance obligations include reporting actual ecb transactions (april 9), esic and pf return filings (april 15), and various.

Source: kieraellis.pages.dev

Source: kieraellis.pages.dev

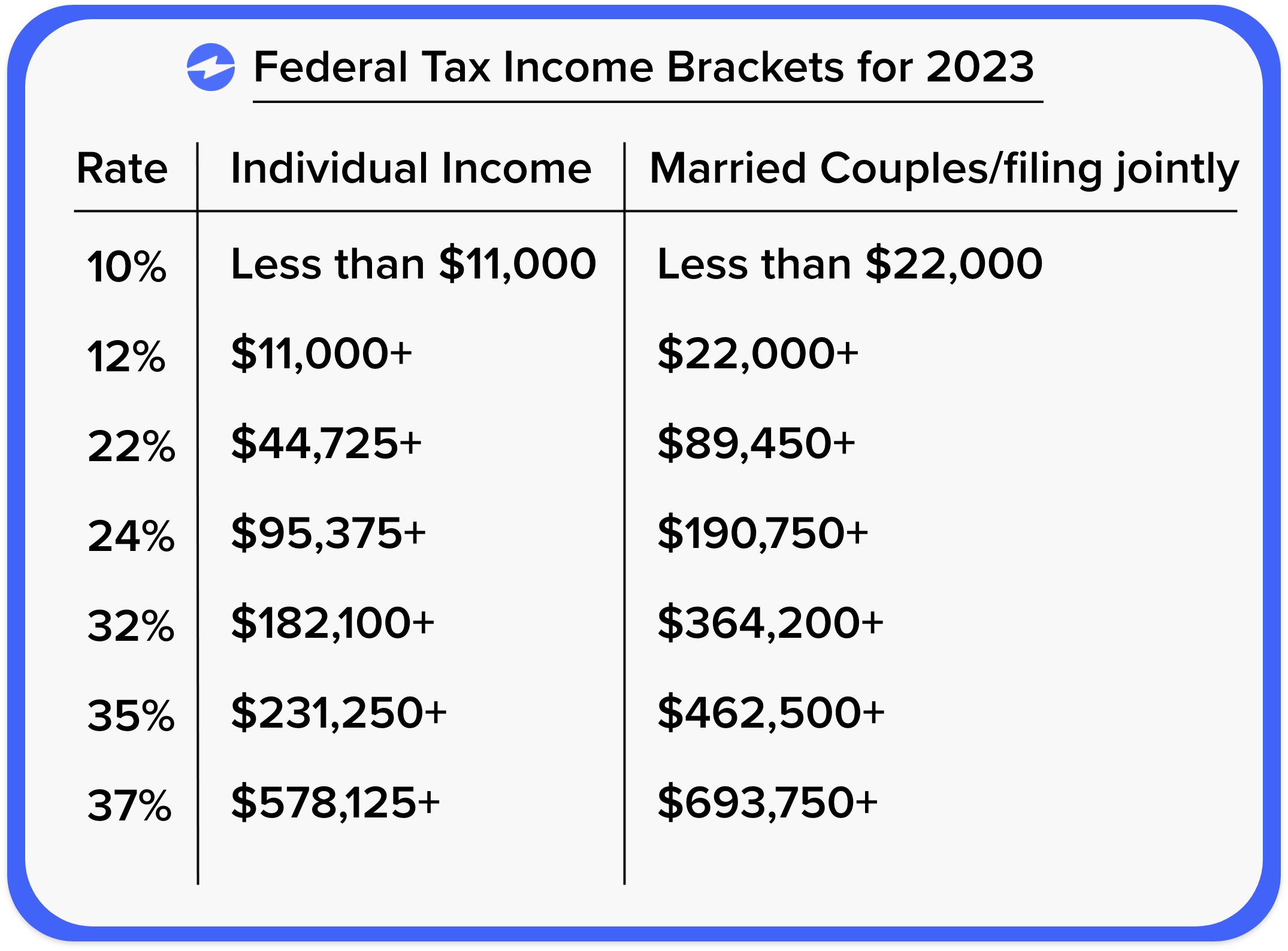

Get Ahead of the Curve Preparing for the Major Tax Changes of 2026 Avoid penalties with timely filings. This comprehensive guide outlines all the important dates—from advance tax payments to the filing of various statutory forms—that you need to monitor.

Source: www.pinterest.jp

Source: www.pinterest.jp

BIR Tax Deadlines Tax deadline, Tax, Business entrepreneurship A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. Avoid penalties with timely filings.

Cube Accounting Our legendary Key Dates for the 20252026 Tax Year A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. This comprehensive guide outlines all the important dates—from advance tax payments to the filing of various statutory forms—that you need to monitor.

Source: lineabhildagard.pages.dev

Source: lineabhildagard.pages.dev

Mich State Tax Refund Calendar 20252026 Amanda Hermina A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. In april 2025, major compliance obligations include reporting actual ecb transactions (april 9), esic and pf return filings (april 15), and various.

Source: www.calendarlabs.com

Source: www.calendarlabs.com

2026 US Fiscal Year Template Free Printable Templates The due date for belated and revised. A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026.

Source: florencemlowem.pages.dev

Source: florencemlowem.pages.dev

Why Do I Have Estimated Tax Payments For 2025 Florence M Lowe The due date for belated and revised. A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026.

Source: ebizcharge.com

Source: ebizcharge.com

How Much Does A Small Business Pay In Taxes? A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026. In april 2025, major compliance obligations include reporting actual ecb transactions (april 9), esic and pf return filings (april 15), and various.

Source: teresaagarciaa.pages.dev

Source: teresaagarciaa.pages.dev

Corporate Tax Filing Deadline 2025 Calendar Teresa A Garcia As per the latest amendments, companies requirements for the compliances have been changed in comparison to the. A complete guide to important due dates for income tax filing, gst returns, tds & tcs payments and filing, roc compliance, professional tax (pt), provident fund (pf), employee state insurance (esi), and accounting from april 1, 2025, to march 31, 2026.